Last updated on February 22nd, 2024 at 05:40 pm

Become a CPA (certified public accountant) can open doors for you in a variety of fields- accounting, auditing, taxation, corporate management, investment banking, business consulting, business finance expert, and more.

Of course, you’ll first need to pursue a CPA course in Kenya to get this crucial certification from KASNEB (The CPA course in Kenya is tested by the Kenya Accountants and Secretaries National Examinations Board).

Below is everything you need to know about pursuing the CPA course in Kenya and qualifying as a certified public accountant.

Let’s dive in:

CPA course in Kenya – all you need to know if you want to do CPA in Kenya including CPA course units in Kenya

First thing first: what are the minimum entry requirements to be registered for the course?

Here they are:

CPA course requirements in Kenya

KCSE mean grade: C+ (plus) overall or its equivalent (there are no additional subject requirements).

Alternative acceptable entry requirements:

You can also be allowed to register with the following qualifications…

A degree from any recognized university OR

Be a holder of KASNEB Accounting Technician Diploma (ATD) course (Or ATC/KATC) or any other KASNEB diploma or any KASNEB’s professional examination certificate.

That means graduates of KASNEB courses such as CS (Certified Secretaries) and CCP(Certified Credit Professionals) will be accepted.

In addition, KASNEB considers these qualifications for admission into the CPA course:

- Various certificates/diplomas as might be approved by the examiner. These may include courses like a KNEC Diploma in Accounting and ACCA.

The good thing is that those who apply with various certificates, diplomas, or degrees can get exemptions in several papers across various CPA Sections (more on this later) so you’re likely to complete the course in a shorter time.

Your next step if you have met the above entry requirements is registering with KASNEB- registering with KASNEB makes you a member of KASNEB meaning you’ll be allowed to sit for exams in future CPA exam sittings.

So, how should you register with KASNEB?

TIME OUT

📣 Hey there! Are you looking for the best courses, top colleges and universities, career guidance, and exciting scholarship opportunities in Kenya? Look no further! Join our Facebook page to stay up-to-date with all the latest information and insights on these topics.

So Please follow Kenya Education Guide on Facebook here for more updates about best courses in Kenya, best colleges and Universities in Kenya, Career choice options, Scholarships in Kenya, etc

🙏Thanks.

Now proceed reading below..👇

How to Register With KASNEB (how to get KASNEB registration number)

The registration is simple:

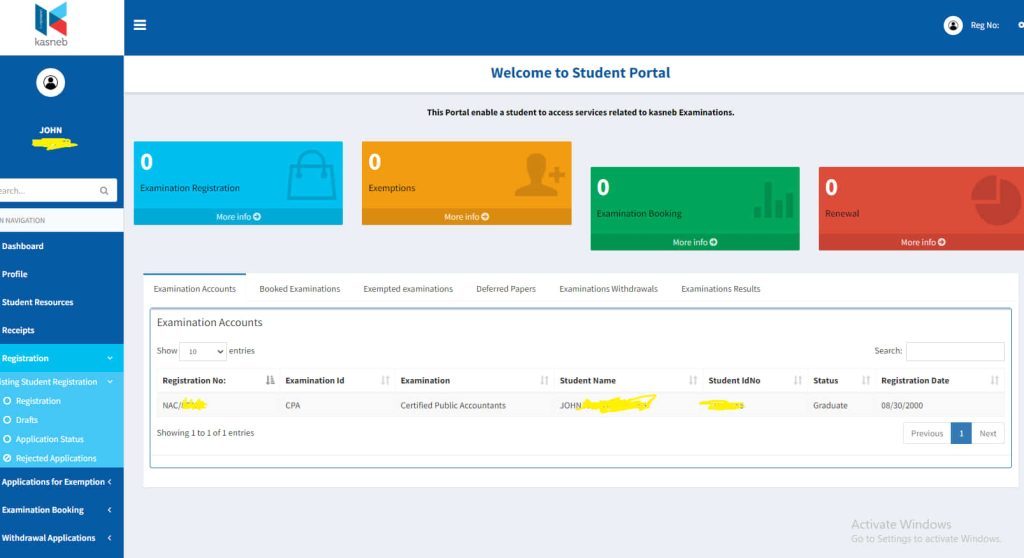

- Head over to KASNEB student portal (https://online.kasneb.or.ke/Register.aspx) and fill in your personal info in the new student registration tab. Also, make sure you follow the instructions- for instance, your name should be typed as per your national ID card/birth certificate.

- Next, fill in your personal email address and phone number(give working address and number).

- Next, type in your national ID card number/birth certificate no if you’re a minor

- From there, click register

- Confirm sign-up by choosing YES, PROCEED

- Your account will be created successfully and login detail sent to your email address so open your email account and use those details to log into your new KASNEB account

- Once logged in, you can go to the REGISTRATION tab and commence registration (choose new registration) – just tap/click on it. Scan your documents ready (in PDF format) because you have to upload your KCSE results slip/certificate, transcripts, a copy of your national ID/birth cert, and every other supporting document when registering. Also, you’ll take a passport photo of yourself and have it ready in your computer for upload(check the requirements of your passport photo for it to be up-loadable first). Simply follow the steps (next>next>next)

Passport requirements

- Format: JPG Image Only

- Size: 45mmx35mm

- Color: Must be Full color

- How it should be taken: Full face and centered

- Background: Must be White

- Smile: Must be Neutral

- Eyes: Must be Open

- Headgear: Not allowed

Soft copy documents requirements

- Identity Card (National ID) or your birth certificate or Passport in (pdf) format.

- All your academic certificates in (pdf) format

Note: Please pay the KASNEB registration fee (Kshs.7500) immediately via MPESA (you’ll be automatically prompted when you finish doing everything else during registration) because you can only access the syllabus and reading materials (on your portal) after paying registration fee.

You can also also download e-kasneb app from Playstore to help you do the registration and book kasneb CPA exam.

After registration, you’ll be allocated an official student ID number.

I also encourage you to register with ICPAK once you get registered as a CPA student as doing that can give you a lot of benefits including getting preference when it comes to internship opportunities and workshops (for IPD hours as a trainee CPA)

How to pay KASNEB fees via e-KASNEB app

KASNEB encourages students to pay via the e-kasneb app.

Go to PlayStore and download the app then follow the steps to make your payment.

TIME OUT

📣 Hey there! Are you looking for the best courses, top colleges and universities, career guidance, and exciting scholarship opportunities in Kenya? Look no further! Join our Facebook page to stay up-to-date with all the latest information and insights on these topics.

So Please follow Kenya Education Guide on Facebook here for more updates about best courses in Kenya, best colleges and Universities in Kenya, Career choice options, Scholarships in Kenya, etc

KASNEB Payment Deadline – When is the deadline to register for CPA in Kenya ?

The deadline to register and book CPA examination is usually thirty days before next exam (it is actually the last day of the month prior) to the next examination date.

So for April Exams, deadline is 31st March.

Likewise, for August exam, deadline is 31st July.

Lastly, if you want to sit December exams, deadline is 3oth November.

But you can only access materials after paying for consider paying at least the registration fee first – you can pay for exam by the above deadlines if you’re not able to pay for the two items at once.

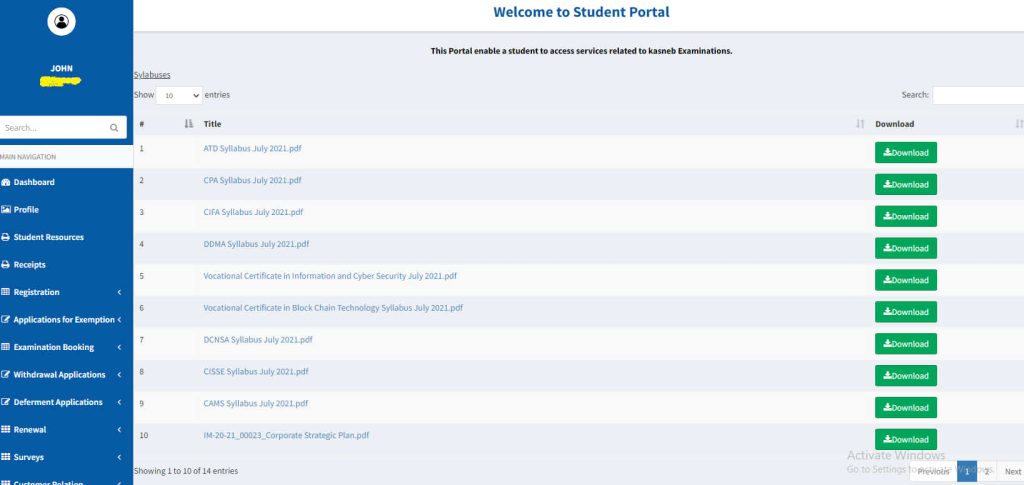

E-library

All CPA materials including the syllabus are available from e-kasneb app and your student portal (if you’re using a computer) so make sure you go to the student resources tab once you pay.

You can also get more resources via the official KASNEB e-library portal here

When it comes to booking for your first exam, you need to be aware of the following…

How much is CPA in Kenya?

CPA exam fees in Kenya / KASNEB CPA Fee Structure

The exam fee depends on the section you’re booking exam for (each section under the current CPA syllabus has 3 levels- refer to the CPA course structure after this section to confirm the units students tackle in each section).

Foundation level:

- Fee per paper 1-shs..1400

Intermediate level:

- Fee per paper 1-shs..2400

Advanced level:

- Fee per paper 1-shs..3600

- Practical Business& Data analytics paper – shs…7500/-

Other CPA Course Fees in Kenya / CPA fees in Kenya

- CPA registration fee (for new student- payable once) -7500/-

- Registration renewal fees– This is paid annually by 1st July to renew your KASNEB membership. The amount payable is shs..2000. Remember you cannot sit for exams without paying any renewal fee arrears. Actually, failure to pay for the renewal fee for three consecutive years may make your membership to lapse.

- Exemption fees- As explained earlier, students who apply for CPA with an acceptable certificate, diploma, or degree course can be exempted from certain units once they apply. The catch is: you have to pay for each paper you’re exempted in. The exemption fee is shs.2500, shs.3500, and shs.4500 per paper for exempted papers in Foundation, Intermediate, and Advanced levels respectively.

A word on CPA renewal fee

As mentioned earlier, you must renew your membership with KASNEB annually on 1st July. Do not forget that newly registered CPA students need to renew their KASNEB registration on the 1st day of July immediately following the first examination sitting you’re first eligible to book after registering.

The renewal is 2000/- and you can renewal from the student portal or e-KASNEB app promptly.

Otherwise, your registration lapses and you cannot be allowed to book for any exams until you pay the pending renewal fee (you have to add the renewal fee to the exam fee if you’ll be booking any exam).

Remember your account is deactivated if you don’t pay renewal fee for 3 consecutive years (and you have to pay an activation fee+ 3 years renewal fee to have it reinstated) if you had not completed the course.

CPA exam payment deadline

The CPA Exams are usually booked by 15th of March (for May exams) and 15th September (November exams).

That is the official KASNEB deadline for exam registration although the examiner may extend it by a few days from time to time.

CPA course structure in Kenya – A list of CPA Course Units in Kenya under the new syllabus

The CPA is at the moment divided into three levels, each with 6 subjects/units. You take all the 6 units in each level at once or any number you wish to start with- what is important to keep in mind is that to become a CPA(K) holder, you have to pass the 16 subjects/units (or 17 if you will be doing two specialization papers) plus one additional data analytics paper .

Here are the units and the overall structure of the CPA course in Kenya:

Foundation Level

- Financial Accounting(FA)

- Communication Skills(CS)

- Introduction to Law& Governance

- Economics(Econ)

- Quantitative Analysis(QA)

- Information Communication Technology(ICT)

Intermediate Level

- Company Law(CL)

- Financial Management(FM)

- Financial Reporting and Analysis(FRA)

- Auditing and Assurance(AA)

- Management Accounting(MA)

- Public Finance& Taxation

Advanced Level

a. Compulsory papers

- Leadership and Management(LM)

- Advanced Financial Reporting & Analysis(AFRA)

- Advanced Financial Management(AFM)

b. Specialisation papers (One to be selected, double specialisation allowed)

- Advanced Taxation(AT)

- Advanced Auditing and Assurance(AAA)

- Advanced Management Accounting(AMA)

- Advanced Public Financial Management(APFM)

- Business Data Analytics(Practical Paper)

In addition to these papers, you are required to:

- Attend official workshops on soft skills, ethics, and emerging issues once organized by kasneb and/or ICPAK

and earn necessary IPD hours) - Get 1-year practical experience(from a relevant internship), or alternatively attend official workshops on work-based simulation again organized by kasneb and/or ICPAK.

Remember that you cannot be allowed to jump to a higher level until you pass the papers in the preceding level (but the order you take the particular papers in a level in does not matter).

In other words, you have to pass one level before progressing to the next.

ALSO READ: CPA Kenya exemptions (for all courses)

CPA pass mark in Kenya

The pass mark is typically 50%. Put simply, you must attain a score of 50% in every paper in a level for you to pass your level exam.

But if you do not pass, credits for the papers you have passed will be retained until you pass the remaining papers (so you just resit the paper you have failed in only and you can repeat as many times as necessary without a limit until you pass).

How many times can you retake the CPA exam Kenya?

Unlike in the past when there was a set number of retakes allowed, you can repeat as many times as necessary without a limit until you pass the papers in the relevant level.

Where can I study CPA in Kenya?

Joining a CPA college vs self-study

To help you prepare for the CPA exams -the exam needs thorough preparation to pass- you can opt to join one of the CPA colleges in Nairobi or choose to study privately (using the materials in the app).

If you take the latter route, you can as well purchase study packs online or even buy study videos from providers such as Manifested Publishers.

But if you’d rather have a professional CPA trainer holding your hand(which KASNEB recommends), you can shop around for a good college to join.

If in Nairobi, consider colleges such as:

- Summit Institute of Professionals.

- Royal Business School.

- KCA university- a CPA course in KCA University (or universities such as Strathmore) can go hand in hand with your degree if you’re still a University student.

Another viable option is attending Online CPA Classes in Kenya (read about where to study for CPA online in Kenya in this article)

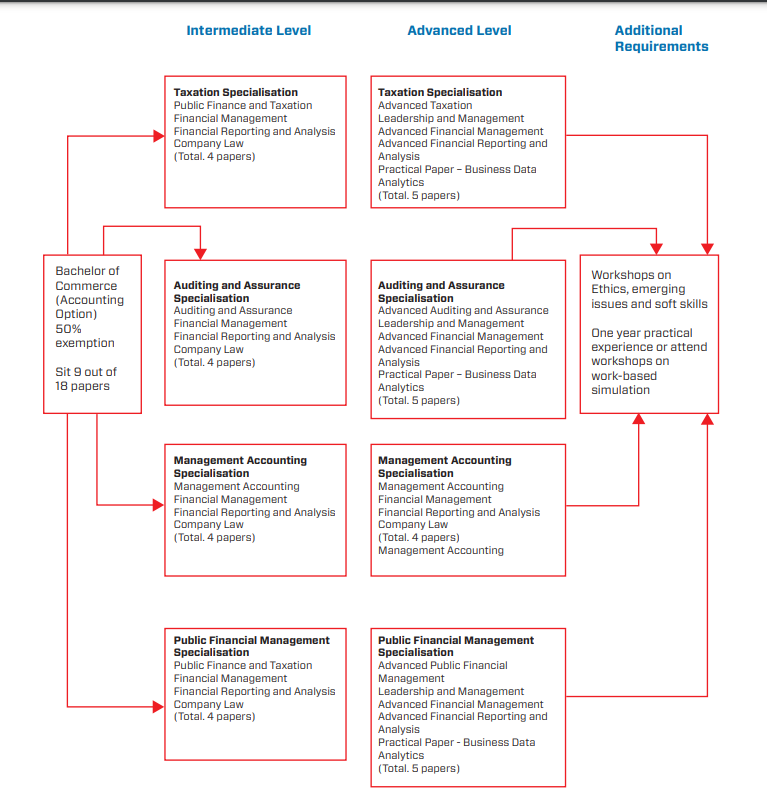

CPA for degree holders

KASNEB has entered into agreements with several universities that allows students taking certain a Degree in acounting courses to be exempted from specific units meaning they tend to finish the course in shorter time.

The following diagram shows where you’ll start your course if you hold one of the listed degrees (please contact KASNEB here for further help before booking for exams- I have shared the contacts at the end of the article)

How long does the CPA course take (how long does CPA course take in Kenya)?

So, how long does it take to study CPA in Kenya?

Well, it will take you 3 years to become a CPA-K holder (if you pass one level per year) and shorter (if you combine more papers in each sitting).

Of course, you need to prepare well because the exams are a bit involving so it is not easy to complete it in 1 1/2 years unless you are very committed.

CPA salary in Kenya – how much can I earn?

On average, CPAs start with the following salary scale depending on how far they have progressed into the course:

- CPA-K holders- the starting range is between Kshs.35000 to Kshs.50000 in most organizations. The amount usually rises after working for about 2 years.

- CPA Part II holders- Those with part II (and no other papers) earn between Kshs. 25000 to Kshs.35000

- CPA Part I holders- CPA Part I holders earn anything between Kshs.15000 to Kshs.20000 at the beginning.

Keep in mind that these are just estimates in both public and private organizations.

Needless to say, organizations such as NGOs and some blue-chip companies tend to start fresh CPAs with higher pay.

Is CPA marketable in Kenya?

Well, while CPA graduates do not get absorbed as fast as they used to be some years ago (there are more CPA graduates nowadays), the course still has great opportunities in Kenya particularly if you match it up with other in-demand qualifications.

Traditionally, the Business Degree+CPA(K) was a hotcake but the trend has changed significantly over the years due to reasons such as technology taking over some of the jobs CPAs would do like computing taxes.

These days, a CPA course in Kenya is more marketable if combined with courses such as Computer Science again because of technological factors.

For instance, forward thinking organizations find it difficult to fill positions like Information System Auditor (This requires CPA+ IT/Computer Science degree+ CISA certification) to help them audit, monitor, control, and assess the information technology/business systems.

Another course that can make you more attractive to employers with a CPA is Forensic Accounting- you’ll need a degree in fields like Computer science or Statistics/Mathematics along with qualifications such as CISA (Certified Information Systems Auditor), CFE (Certified Fraud Examiner), or CIA (Certified Internal Auditor).

And so you may take that direction.

The other potentially lucrative alternative is starting your own consultancy firm specializing in areas such as taxation, investment advisory (people want to know how they can invest to retire young), computerized accounting systems (selling and consulting on accounting software), and auditing (you target small businesses that cannot afford to hire a fulltime auditor).

That’s doesn’t mean that there are no normal jobs- I usually see employers advertise conventional jobs for CPAs such as internal auditor and accountant.

However, you can be sure that the competition is quite tough and its best to come up with out-of-the-box ways to make yourself marketable as a CPA holder.

CPA vs ACCA Kenya – which is better?

In our opinion, none of the two courses is better than the other.

To start with, CPA is essentially more recognized by Kenyan employers and there are more CPA jobs in Kenya than ACCA jobs.

That said, some multinationals ask for an ACCA qualification so it still has its place.

It is also important to note that the two courses follow different structures although the ACCA seems slightly more flexible- for example, ACCA doesn’t have a fixed entry requirement and the only major condition is that you must be able to communicate proficiently in English.

Also, the number of units taken in each course is different not to mention that there’s a requirement that you must attend practical attachment when pursuing ACCA unlike in CPA- not much emphasis is put on the practical attachment bit by KASNEB (please ensure you go for attachment before you complete the CPA course anyway!).

Still on the same topic, the cost of pursuing an ACCA qualification is higher than that of completing the CPA- the exam fee and other ACCA charges are more than what KASNEB levies.

In a nutshell, you need to do your homework adequately before deciding on one over the other.

How do I contact Kasneb?

Use the following KASNEB contacts for further assistance:

Telephone: 020 4923000/ 0722 201 214 /0734 600 624 /020 2712640/020 2712828

Email: info@kasneb.or.ke

Website: http://www.kasneb.or.ke/

Twitter: http://bit.ly/2PeyFZN

FaceBook: https://www.facebook.com/Officialkasneb (Send Message)

Hello.With a mean grade of C+ but with a D+ in Math,does that disqualify one from the CPA course?

Sometimes KASNEB does accept D+. Call them on 0204923000 to confirm

Hello am a student in university and at the sometime I want to take CPA can I manage how I can get materials

I have a degree in Economics and Statistics. Can some papers in CPA be exempted?

Yes. Contact KASNEB

I am unable to continue with university,

am I eligible to study CPA?

Yes

Am currently studying

Bachelor of accountancy and financial Management and am willing to study CPA as well

That can be a great combination. Go for it

Am currently pursuing diploma in accountancy. Am I eligible to study CPA?

https://kenyaeducationguide.com/cpa-course-in-kenya/

A very informative, well detailed article. Answered every question I had. Thank you.

Our pleasure

I did diploma in accounting and finance and I wanted to apply for CPA, can I do so anytime soon or wait till November.?

Do so right away. Contact KASNEB

I DID DIPLOMA IN ACCOUNTING IN A PRIVATE UNIVERSITY, CAN I APPY FOR CPA

Yes.Contact KASNEB

I AM DONE WITH MY COURSE OF ACCOUNTING AND FINANCE AT DIPLOMA LEVEL CAN I APPLY FOR CPA

Yes

I am from South Sudan and currently at the university pursuing a bachelor of science in accounting, will I be eligible for a CPA Kenya Online?

i am doing entrepreneurship can i do cpa

Yea

Hello

I am doing bachelor of education, is it good If I do CPA course and would it be useful?

My subject combination is mathematics and chemistry. I am not yet completed my university study. But always interested to do another course of course of CPA . Kindly let me know whether doing it right now has benefits or disadvantages

I had a C plain in my KCSE. I need to do CPA. Kindly advice.

Iam currently studying education Arts (mathematics and Business Studies) can I do CPA as part time course?

And where can I do it Eldoret?

am a student taking a degree economics and finance can I take cpa

I have done diploma in business managent.

IM I legible to go for CPA course?

I love CPA,How do I access study materials?

I scored c minus and am interested to do a CPA course kindly advice

Am a graduate of BBA from the Catholic University of South Sudan (affiliate of CUEA), am I eligible for the CPA course? and is it possible to take it at a long distance Program?

I have a D can I pursue for CPA

I am currently pursuing my bachelor degree Program and expecting to graduate in 2024. Am I eligible to join CPA at the moment? I would like to hearing from you anytime possible.

I am currently studying my degree program but I want to start pursuing CPA. So I was asking what happens when CPA exams collide with my end of semester exams, or is it rare for both exams to collide?