Last updated on April 10th, 2024 at 03:14 am

If you’re contemplating taking a CPA certification in Kenya, you may finish the course in a shorter time if you apply for (and get) some or all of the available CPA Kenya exemptions.

You’re obviously eligible for the CPA Kenya exemptions if you tackled and passed the various units while pursuing a degree or diploma at an institution recognized by KASNEB.

Exemptions are also available for holders of certain certifications including ACCA and a number of courses examined by KNEC and KIM (Kenya Institute of Management).

The other groups to benefit from the exemptions are holders of KASNEB technician, diploma, and professional qualifications.

Having said that, no exemptions are given in units covered in the higher sections of the CPA course.

Also keep in mind that exemptions are granted on a paper-by-paper basis.

Read on to understand where you stand and which units you should apply for exemptions in when registering with KASNEB.

CPA Kenya exemptions across all CPA sections

Here are the units you can be exempted from when taking the CPA course for every accepted course.

a. Holders of other KASNEB qualifications wishing to pursue the CPA course

Overall, holders of KASNEB diplomas get a maximum of 6 exemptions while those holding KASNEB technician qualifications are exempted from a maximum of 3 units in the KASNEB CPA syllabus as you will see below.

CPA exemptions for CS/CPS graduates

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

- Economics

- Public Finance & Taxation

- Company Law

- Financial Management

- Management Information Systems(MIS)

- Strategy, Governance & Ethics

CPA exemptions for CICT KASNEB graduates

- Financial Accounting

- Entrepreneurship and Communication

- Management Information Systems

- Strategy, Governance & Ethics

CPA exemptions for CIFA/CSIA graduates

- Financial Accounting

- Entrepreneurship and Communication

- Economics

- Public Finance and Taxation

- Financial Management

- Management Information Systems

- Quantitative Analysis

- Strategy, Governance & Ethics

- Advanced Financial Management

CPA exemptions for CCP graduates

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

- Economics

- Public Finance and Taxation

- Company Law

- Financial Management

- Management Information Systems

- Quantitative Analysis

- Strategy, Governance & Ethics

CPA exemptions for Accounting Technicians Diploma (ATD) graduates

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

- Economics

- Management Accounting

- Public Finance and Taxation

CPA exemptions for Diploma in ICT holders (KASNEB)

- Entrepreneurship and Communication

CPA exemptions for Diploma in Credit Management holders (KASNEB)

- Commercial Law

- Entrepreneurship and Communication

- Public Finance and Taxation

CPA exemptions for Accounting Technicians Certificate (ATC) holders

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA exemptions for Information Communication Technology Technicians (ICTT) holders

- Entrepreneurship and Communication

CPA exemptions for Credit Management Technicians (CMT) holders

- Commercial Law

- Entrepreneurship and Communication

- Economics

CPA exemptions for Investment and Securities Technicians (IST) Holders

- Entrepreneurship and Communication

- Economics

b. Exemptions for Holders of Various University Degrees

CPA Part I exemptions

University graduates are generally exempted from CPA Part I units based on equivalent course units undertaken at their undergraduate/postgraduate levels.

But not all degrees qualify for the wholesale exemption and some conditions apply (read more below).

Note: No exemptions are awarded for introductory papers such as Introduction to FA (Financial Accounting), Introduction to Economics, etc. under the CPA syllabus except where you have sufficiently covered the unit, mostly as two distinct papers.

Applicable rules

| Paper | Who can be exempted |

| Management Accounting | Holders of any undergraduate business degree with a specialization in accounting.

However, holders of an undergraduate business degree with a specialization in either micro finance/finance must show that they passed an equivalent unit. |

| Public Finance & Taxation | Holders of an undergraduate business degree specializing in either finance/ accounting/ micro finance. There will be no exemption for those who undertook the public finance component only. |

Part II exemptions

No exemptions will be awarded in CPA Part II except where the paper(s) you wish to be exempted from were tackled at the degree level as concentrations/ options/majors and not as mere units.

Then, even where given, Part II exemptions are only limited to the papers listed below and are again subject to the specified conditions:

TIME OUT

Hey there! Are you looking for the best courses, top colleges and universities, career guidance, and exciting scholarship opportunities in Kenya? Look no further! Follow us on TikTok below to stay up-to-date with all the latest information and insights on these topics.

@kenyaeducationguide

You can also follow Kenya Education Guide on Facebook here for more updates about best courses in Kenya, best colleges and Universities in Kenya, Career choice options, Scholarships in Kenya, etc

Thanks.

Now proceed reading below..

Applicable rules

| Paper | Who can be exempted |

| Company Law | Holders of an LLB degree from East African region universities and holders of an LLB degree from outside the EA who have been already admitted as advocates of Kenya’s High Court. |

| Financial Management | Holders of an undergraduate business degree specializing in either finance/ accounting/ financial engineering/ economics & finance (as one option). |

| Management Information Systems | Those having an undergraduate degree in information technology/computer science/business information technology or any other degree with a minor in IT (Information Technology)- the minor must appear on the transcripts as well as the degree certificate. |

| Quantitative Analysis | Holders of degrees with a specialization in:

· Management sciences or operations research (excluding Strathmore University) · Financial economics/economics and statistics (as one option) · Mathematics · Actuarial science (JKUAT) · Financial engineering (JKUAT) |

CPA Part III exemptions

In general, no exemptions are awarded here to degree holders.

CPA Kenya exemptions – summary schedule for all degrees

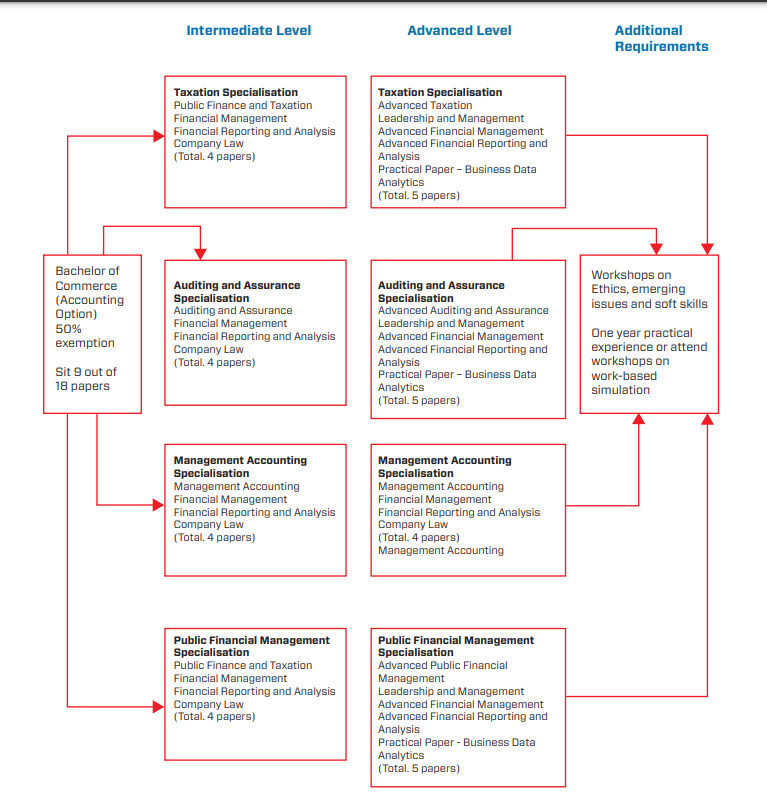

Here is a summary of the KASNEB CPA units you may be exempted from if you have a Degree in Accounting(Bachelors):

Bachelor of Commerce/Business Management (Accounting option)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

- Management Accounting

CPA Section 3:

- Financial Management

Notes:

- For Public Finance & Taxation paper, you must have covered an equivalent unit or units with a strong bias towards taxation practice.

- For MIS, you must have a minor in IT (information technology) to qualify.

CPA exemptions for BCOM finance option and a Business Management degree (Finance or Micro-Finance Options)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 3:

- Financial Management

Notes:

- For Public Finance & Taxation paper, you must have covered an equivalent unit or units with a strong bias towards taxation practice.

- For Management Accounting, you must have covered an equivalent unit.

- Lastly, those having a minor in IT (information technology) may be exempted from MIS.

CPA exemptions for actuarial science (JKuAT)

CPA Section 1:

- Financial Accounting

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 4

- Quantitative Analysis

CPA Kenya exemptions for Bachelor of Economics & Finance

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 3:

- Financial Management

CPA exemptions for Bachelor of Financial Economics

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 4

- Quantitative Analysis

CPA exemptions for Bachelor of Science (in International Business Administration) – Finance Concentration/Major

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 3:

- Financial Management

CPA exemptions for Bachelor of Science in Economics & Statistics

CPA Section 1:

- Financial Accounting

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA exemptions for Bachelor of Arts (Economics)

CPA Section 1:

- Financial Accounting

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 4

- Quantitative Analysis

Bachelor of Arts (General)

CPA Section 1:

- Commercial Law (selected cases)

- Entrepreneurship and Communication

Bachelor of Education (Arts)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

Bachelor of Commerce (Actuarial Science)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

Bachelor of Science (Management Science Option)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 4

- Quantitative Analysis

Bachelor of Purchasing & Supply Chain Management

CPA Section 1:

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

- Financial accounting (selected cases)

Bachelor of Business Administration (Management Option) / Bachelor of Business Management (International Business Management – M.K.U)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

Bachelor of Commerce (Marketing Option)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Kenya exemptions for Bachelor of BIT (Business Information Technology)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 4:

- MIS

Bachelor of Science in Financial Engineering (JKUAT)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 3

- Financial management

CPA Section 4

- Quantitative Analysis

Bachelor of Science in Mathematics and Computer Science

CPA Section 1:

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 4

- Quantitative Analysis

- MIS

Bachelor of Science in Mathematics

CPA Section 1:

- Entrepreneurship and Communication

CPA Section 4

- Quantitative Analysis

CPA Kenya exemptions for Bachelor of Laws (LLB)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 3

- Company law

Note: You might also be exempted from the Economics paper if you have undertaken micro and macro economics at the degree level.

c. CPA Kenya Exemptions for those holding KNEC, KIM, & KSL (Kenya school of law) diploma papers

Diploma in Accountancy & Diploma in Banking/Finance (KNEC)

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

Diploma in Business Administration, Diploma in Management, Purchasing, and Supplies, & Diploma in HRM (Human Resources Management) by KIM

CPA Section 1:

- Commercial Law

- Entrepreneurship and Communication

Note: For Financial Accounting exemption, you must have passed an introductory paper then subsequent papers in Accounting, like Finance and Cost Accounting I & II.

Diploma in Law (KSL)

CPA Section 1:

- Commercial Law

ACCA CPA exemptions

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Management Accounting

CPA Section 3:

- Financial Management

- Financial Reporting

CPA Section 4:

- Auditing and Assurance

- Quantitative Analysis

CPA exemptions for holders of ICSA-UK (institute of company secretaries and administrators) qualifications.

CPA Section 1:

- Financial Accounting

- Commercial Law

- Entrepreneurship and Communication

CPA Section 2:

- Economics

CPA Section 3:

- Financial Management

CPA Section 4:

- MIS

- Quantitative Analysis

CPA Section 5:

- Strategy, Governance & Ethics

That’s all…

How to apply for exemptions

Applicants for exemptions must complete the designated KASNEB Exemptions Form (download it from KASNEB’s website: www.kasneb.or.ke ) and attach all the required documents as indicated in the form.

These include certified copies of the relevant academic and professional transcripts and certificates.

Those awaiting graduation are advised to attach the applicable certified copies of their transcripts together with a letter from their university confirming that they have completed their undergraduate studies and are just waiting for graduation.

Note: You cannot be exempted without having fully completed the course –including research projects/thesis- you’re basing your application on.

When to apply for exemptions

As mentioned earlier, you should submit your application for exemptions when registering with KASNEB or at least before paying for your first CPA examination.

You can also apply for exemptions based on qualifications you obtain after registering with KASNEB as long as such an application relates to papers to be taken in subsequent section(s).

What else to know

You’ll forfeit an awarded exemption in a given paper if you, for any reason, book to write the exam in such a paper.

Similarly, you cannot apply to be exempted in a paper you’ve already sat.

KASNEB Exemption fee (CPA)

- CPA Part I (per paper)- Kshs. 2500

- CPA Part II (per paper)- Kshs. 3500

- CPA Part III (per paper)- Kshs. 4500

KASNEB contacts

Use the following details to channel all enquiries about CPA exemptions and other KASNEB exams to the examination body.

Physical location: KASNEB Towers, Upper Hill, Off Hospital Road (you can also visit the KASNEB desk at your nearest Huduma center).

Postal address: P.O. Box- 41362, 00100. Nairobi, Kenya.

Call: 020 4923000 / 020 2712640

Website: www.kasneb.or.ke

Email: info@kasneb.or.ke

Wrapping it up

It’s worth noting that the above exemptions are not automatic and there are situations under which you may be denied despite seemingly being qualified.

For example, this can happen if KASNEB feels that there was insufficient coverage of the unit’s content in your other qualification.

Students are also advised that KASNEB’s exemption policy is updated after every few years and it’s important to check with KASNEB to confirm if something has changed.

LATEST UPDATE:

Here’s the latest official document outlining the various exemptions for KASNEB courses for holders of all eligible qualifications – go through the document to be sure of where you’ll start.

I’m holding of Diploma in Banking and finance ad i have passion for being a CPA holder in kenya,

I beg to know if it one can go on with CPA course learning part time.

thanks,

Benson.

Yes. See the colleges you can join here https://kenyaeducationguide.com/online-courses-in-kenya/

https://kenyaeducationguide.com/online-cpa-classes-in-kenya/

Am a graduate of bachelor of science in Mathematics and am owning a CPA certificate up to K.Where can I be employed?

Holder of Bachelor of Economics and Finance which are the units can I be exempted from?

Hello, when applying for an exemption do you still pay the KASNEB registration fee?

Yes

Hi,I have a degree in finance and an MBA.Can I be excempted.How can you advice .

IAM actuarial science graduate who want to pursue CPA course,,,what exemptions do I get,,,,,and which colleges offer cpa

Hello, i hold diploma in business management and degree Bachelor of commerce (banking and finance) am l illegible for exemptions

I hold a diploma in cooperative management from cooperative university, am I eligible for exemption